ebike tax credit status

House of Representatives in February 2021 would create a. The government is proposing tax credits for anyone who.

A 900 Tax Credit For E Bikes Is Part Of Infrastructure Bill Los Angeles Times

The proposal as it is currently written would allow a 15 percent refundable tax credit for qualified electric bicycles.

. This is not a motorcycle this is an e-bike. As stated you might get up to a 1500 credit to defray 30 of the cost of an electric bike. Much like the House bill which Rep.

This tax credit is available on any electric bike that has a motor that delivers no more than 750 watts and is equipped with the US or foreign EPA-certified emissions reduction. Jimmy Panetta D-CA introduced in February Schatz and Markeys proposal would offer Americans a. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years.

A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount. This credit would be available to all e-bike. Electric Bicycle Incentive Kickstart for the Environment E-BIKE Act introduced in US.

As part of Bidens Build Back Better bill individuals who make 75000 or less qualify for the maximum credit of up to 900. The credit was capped at a. Similar or related legislationprograms.

Electric motorcycles already receive a 10 federal tax credit but that figure was tripled to 30 in the new bill according to the Washington Post. If passed e-bike buyers could claim a credit of up to. Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act This bill allows a refundable tax credit for 30 of the cost of a qualified electric bicycle.

1019 is a bill in the United States Congress. The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500. This means you can buy an electric bike costing as much as 5000 or more to get the full 1500.

Your electric bike might be tax deductible because they are more expensive but also beneficial than regular bikes. A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States.

This tax credit would be wonderful news to avid e-bikers and new riders alike. E-BIKE Act Specifics and Challenges. The law has not yet been passed as of August 2021 but if approved it would allow 30 with a.

Understanding The Electric Bike Tax Credit

Schwinn Ec1 Cruiser Style Electric Bicycle 26 In Wheels 7 Speeds Blue Walmart Com Best Electric Bikes Bicycle Schwinn

What Makes A Good Electric Bike Incentive Program Peopleforbikes

Let S Pass The E Bike Act Rei Co Op

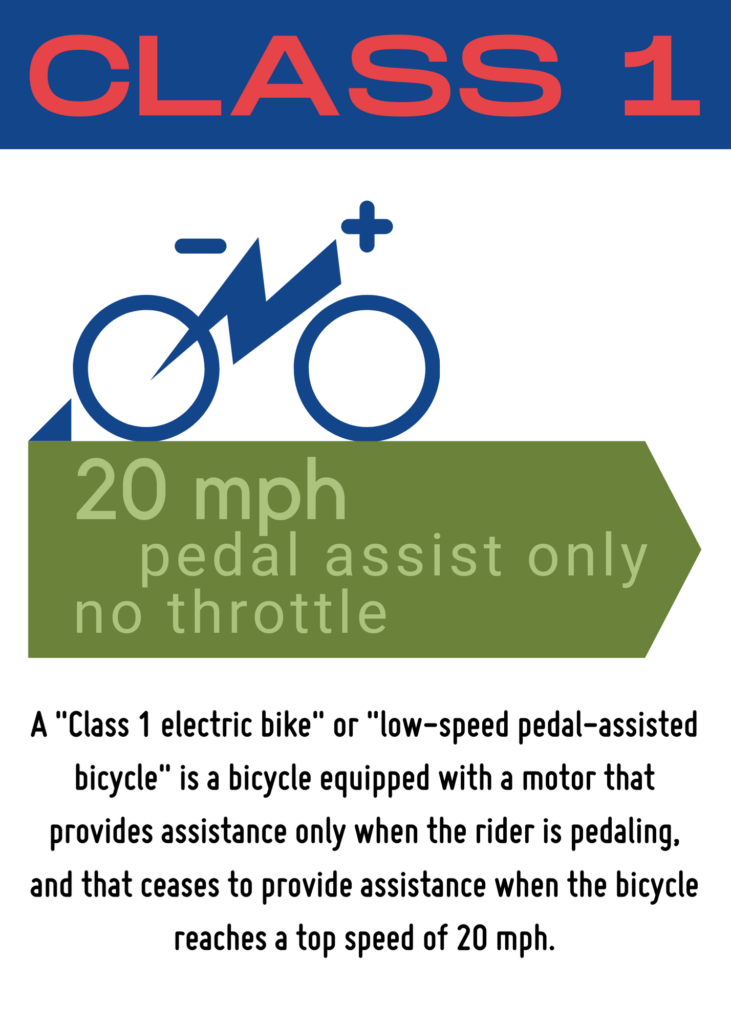

Ebike Classifications And Laws San Diego County Bicycle Coalition

Local E Bike Advocates Press On After Losing Out In Biden Climate Bill Bikeportland

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Electric Bike Rebate Green Mountain Power

Mach E Bike Rack In 2022 Bike Rack Ebike Bike

/should-i-buy-electric-bicycle-everything-you-need-to-know-primer-faq_color-a0ed8ab6ba9d4e8bbf0b949127f46114.png)

Should I Buy An Electric Bicycle Here S Everything You Need To Know To Get Started

Ebike Rebates And Incentives Across The Usa

Comparing Serial 1 5 000 Electric Bike With Radmission 1 100 Ebike

About Us Gocyclemarine Com The Most Innovative Lightweight Folding Bike For Yachting Enthusiasts Folding Bike Folding Electric Bike This Is Us

/cdn.vox-cdn.com/uploads/chorus_image/image/69626470/1311180591.0.jpg)

The Senate S E Bike Act Could Make Electric Bikes A Lot Cheaper The Verge

Powering Their Way Into The E Bike Boom Forbes Ebike Bike Electric Bike

Us Tax Credit For Electric Bicycle Purchases Back Up To 30 In New Proposal

900 E Bike Tax Credit Possible In Build Back Better Bloomberg